Story: Business Desk

The Ghana Cedi, has outperformed all other global currencies against the US dollar over the past six months, buoyed by investor confidence in the country’s potential approval for a US$3 billion bailout from the International Monetary Fund (IMF).

According to Bloomberg’s currency tracker, the Cedi’s remarkable 33% gain since November marks the highest among approximately 150 tracked currencies.

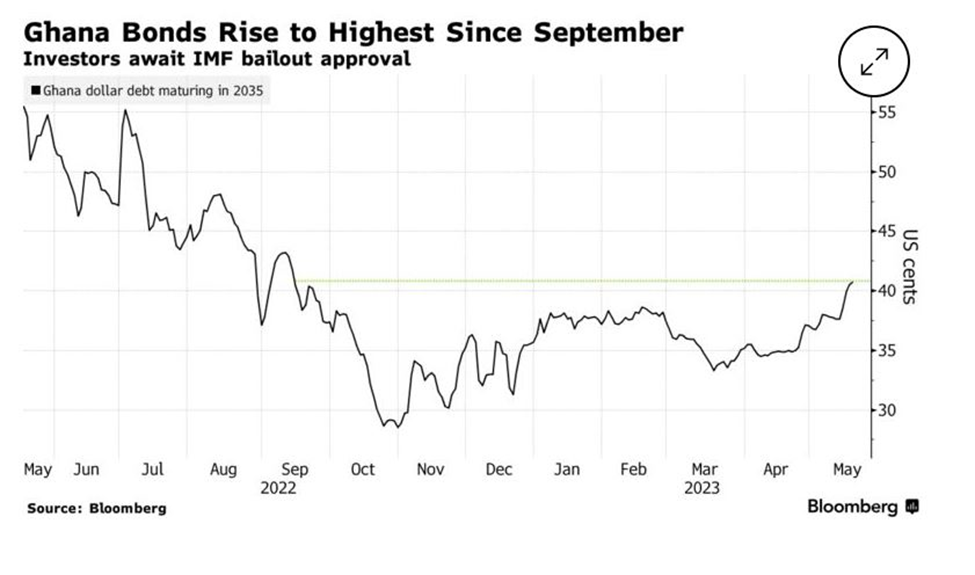

Investors have also enjoyed strong returns from Ghana’s dollar bonds, delivering nearly 12%, surpassing the 3.6% average for emerging and frontier markets in a Bloomberg index.

Minister of State for Finance, Mohammed Amin Adam, expressed optimism about the forthcoming IMF board meeting, stating that the initial US$600 million tranche is expected immediately upon approval.

Subsequently, another US$600 million will follow in November, with the remaining funds disbursed in equal portions of US$350 million every six months, subject to IMF reviews.

The positive sentiment surrounding the potential bailout has contributed to the Cedi’s recent strengthening, with expectations that it may trade below 10 against the US dollar.

Daniel Kavishe, an African economist at Rand Merchant Bank, noted that similar market reactions have been observed in countries receiving IMF programs coinciding with immediate disbursements of funds.

While an IMF spokesperson confirmed the Wednesday board meeting, they refrained from commenting on specific amounts to be received until after the meeting concludes.

The anticipated funds will assist in replenishing Ghana’s foreign-exchange reserves, which have declined by almost 50% since their peak in August 2021.

This decline was primarily due to the central bank utilizing reserves to alleviate pressure on the Cedi following the country’s debt default.

Ghana is utilizing the Group of 20’s Common Framework to restructure its debt as part of its efforts to secure the IMF program.

This framework aims to enhance coordination between traditional sovereign creditors like the Paris Club and newer creditors such as China, the largest lender to emerging economies.

Other countries, including Zambia and Ethiopia, are also leveraging this framework to address their debt challenges.