By Nana Ofori Owusu

Ghana’s Global Pitch in Japan

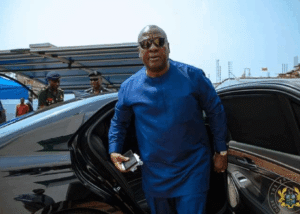

At the 9th Tokyo International Conference on African Development (TICAD-9) in Yokohama, President John Dramani Mahama declared Ghana “open for business.” He outlined reforms to the Ghana Investment Promotion Centre (GIPC) Act that will lower entry thresholds for investors—from the old US$200,000 minimum to as little as US$50,000—making Ghana far more accessible to foreign direct investment (FDI).

President Mahama also highlighted the country’s economic turnaround: inflation down from nearly 23% in 2024 to 13.7%, and a sovereign credit rating upgrade to B- (stable outlook). He invited investors to seize opportunities in energy, infrastructure, tourism, and ports development, positioning Ghana as Africa’s next frontier for global capital.

The Call for Local Contractors

At home, however, Mahama has emphasized that Ghanaian contractors must take the lead in building the nation’s infrastructure. Speaking in Koforidua on July 20 during his “Thank You” Tour, he announced that road contractors cleared by the Auditor-General’s report would be sent back to site. “The Auditor-General has come with his report. So we are going to make the contractors go back to the site,” he declared, adding that those found guilty of double payments would face punishment.

This move is part of his broader effort to restore momentum to stalled projects, while insisting on accountability and giving local firms the opportunity to drive Ghana’s development agenda.

When Foreign Dominance Overshadows Local Enterprise

Despite Ghana’s efforts to attract foreign capital, local businesses remain heavily overshadowed by multinational competitors.

– Construction & Infrastructure: Large contracts are often awarded to foreign firms, sidelining domestic contractors who could benefit from mandated subcontracting and skill transfer.

– Natural Resources: In oil and gas, local content provisions exist, but enforcement is weak. International giants dominate, leaving Ghanaian firms undercapitalized.

– Manufacturing & Trade: Chinese investment alone rose from US$4.4 million in 2000 to US$1.6 billion in 2014, creating growth but also crowding out local traders.

The Collapse of Indigenous Banks

Nowhere has the tension between foreign dominance and local weakness been more evident than in Ghana’s financial sector clean-up (2017–2020), which saw the collapse of nine Ghanaian-owned banks:

1. UT Bank – Aug 2017

2. Capital Bank – Aug 2017

3. uniBank Ghana Ltd. – Aug 2018

4. Royal Bank – Aug 2018

5. Construction Bank – Aug 2018

6. Sovereign Bank – Aug 2018

7. The Beige Bank – Aug 2018

8. Heritage Bank – Jan 2019

9. GN Bank (later GN Savings & Loans) – Aug 2019

GN Bank’s case was particularly symbolic. With over 300 branches, it had the widest retail presence of any bank in Ghana, reaching rural and peri-urban communities often ignored by larger players. Its closure disrupted access to credit for small traders and farmers, while thousands of staff lost their jobs.

Why Indigenous Banking Matters

The collapse of these banks has left Ghana’s financial system dominated by foreign and state-owned institutions. This imbalance undermines the very foundation of sustainable development.

– Financial Inclusion: Local banks like GN Bank served customers that global banks ignore.

– Sovereignty: Without Ghanaian control, credit flows are dictated externally.

– SME Financing: Indigenous banks understood local traders and MSMEs better than foreign institutions.

– Wealth Retention: Profits from Ghanaian banks are reinvested locally rather than expatriated abroad.

As of today, Ghanaian-owned banks control less than 40% of sector assets, with only two among the top eight by earnings.

Mahama’s Vision for Restoration

President Mahama has promised to review the banking clean-up if re-elected. His measures include:

– Conducting forensic audits into the revocations.

– Establishing equity and recapitalization funds to support Ghanaian banks.

– Amending regulations to accommodate models like GN Bank’s rural outreach.

– Strengthening indigenous ownership targets to rebalance foreign dominance.

This, coupled with his commitment to local contractors, suggests a dual-track vision: invite foreign investment, but empower local players to lead.

Conclusion: The Balance Between Foreign Capital and Local Leadership

President Mahama’s message in Japan was clear: Ghana is stable, open, and ready for global partnerships. Yet, true development cannot take place unless Ghanaians themselves control the commanding heights of their economy—from construction to banking.

Foreign investment must serve as a catalyst, not a crutch. The real victory will come when Ghana’s local businesses—contractors, manufacturers, and banks—stand tall, not as spectators, but as leaders of the country’s transformation.

One thought on “Ghana Open for Business Abroad, But True Development Demands Indigenous Power at Home”

top 10 equity release companies