Story: Business Desk

The International Monetary Fund (IMF) and the government have reached a staff-level agreement on the fifth review of Ghana’s three-year programme under the Extended Credit Facility.

The deal clears the way for Ghana to access about SDR 267.5 million, equivalent to $385 million, once it receives management and Executive Board approval. This will bring the total amount disbursed to Ghana since May 2023 to about $2.8 billion.

The IMF mission, led by Ruben Atoyan, held discussions in Accra from September 29 to October 10 2025, to assess progress on reforms and policy priorities under the $3.2 billion facility approved in May 2023.

According to Mr Atoyan, “IMF staff and the authorities have reached a staff-level agreement on the fifth review of Ghana’s economic programme under the Extended Credit Facility arrangement. Upon completion of the Executive Board review, Ghana would have access to SDR 267.5 million (about $385 million).”

He noted that macroeconomic stabilisation was taking root, with growth in the first half of 2025 stronger than anticipated, supported by services and agriculture.

The external sector, he said, had improved on the back of robust exports, especially gold and cocoa, while the cedi appreciated markedly and reserves continued to grow beyond programme targets.

Mr Atoyan said the positive trend was expected to continue into 2026, with growth projected at 4.8 per cent and inflation staying within the Bank of Ghana’s target band of 8 ± 2 per cent.

He commended Ghana for making “notable strides in addressing long-standing challenges in the energy sector,” including the renegotiation of legacy arrears and power purchase agreements with independent power producers, and improved tariff adjustments.

On the fiscal front, he said Ghana recorded a primary surplus of 1.1 per cent of GDP for the first eight months of 2025 and remains on track to achieve the 1.5 per cent target by year-end.

He added that the government was committed to a 2026 budget that maintains the same surplus in line with the new Fiscal Responsibility Framework.

The IMF said discussions also focused on structural fiscal reforms to strengthen public financial management, boost domestic revenue, and entrench fiscal discipline.

On debt, Mr Atoyan said Ghana’s comprehensive restructuring was progressing well, with bilateral agreements concluded with five countries following the signing of a Memorandum of Understanding with the Official Creditor Committee under the G20 Common Framework. Negotiations with remaining commercial creditors are ongoing.

He noted that Ghana’s debt trajectory had improved “markedly” thanks to a stronger macroeconomic outlook and continued fiscal discipline.

The IMF also highlighted the Bank of Ghana’s decision to cut its policy rate by 650 basis points to 21.5 per cent as inflation trends toward the target band.

The central bank, in collaboration with the IMF, has developed a framework to manage foreign exchange flows and build reserves while reducing market volatility.

The statement added that Ghanaian authorities were taking strong steps to ensure financial stability by restructuring state-owned banks, improving crisis management frameworks, and addressing non-performing loans.

The recapitalisation of state-owned banks is expected to be completed by the end of 2025.

Mr Atoyan said Ghana’s governance diagnostic assessment had been completed and will be published soon, adding that efforts to strengthen transparency and oversight must continue, particularly in the gold, cocoa, and energy sectors.

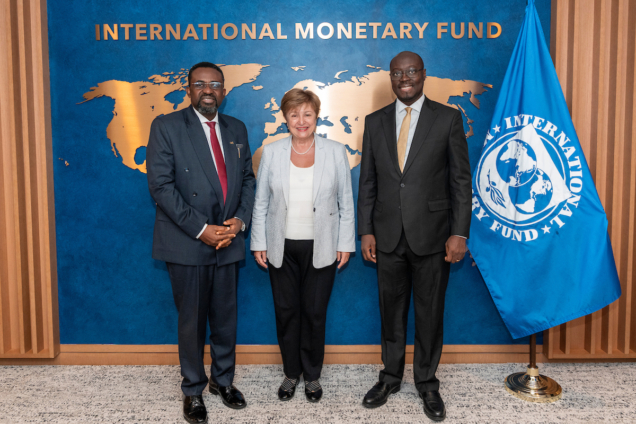

The IMF mission met with Finance Minister Dr Ato Forson, Bank of Ghana Governor Dr. Johnson Asiama, and other government officials.

The Fund expressed appreciation to the Ghanaian authorities for their cooperation and hospitality during the review mission.